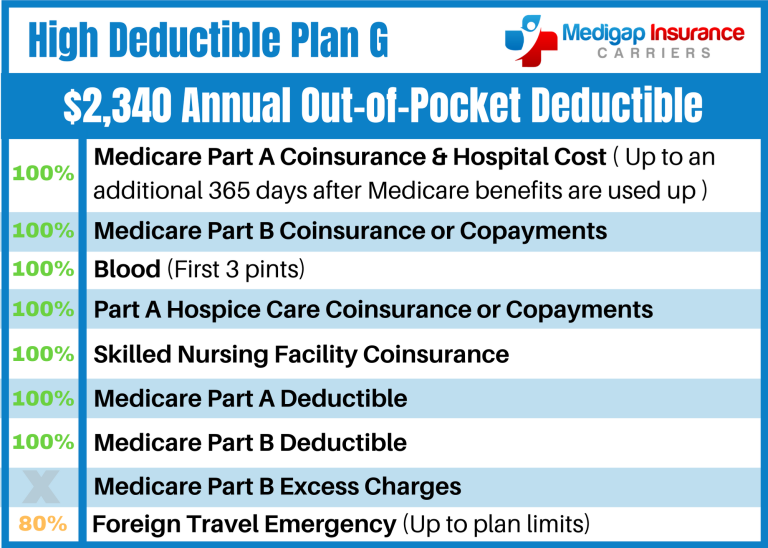

High Deductible Plan G

High Deductible Medigap Plan G (otherwise known as High Deductible Supplement Plan G) contains all of the benefits of regular Supplement Plan G, except that before you can access those benefits, you have to meet a deductible of $2,340. So if you are enrolled in this High Deductible Plan G, when you incur medical expenses, Original Medicare first pays its share (about 80%), then you pay your share- up to the deductible amount. Once you spend $2,340 in out-of-pocket medical expenses, then regular Plan G will kick in. The regular Supplement Plan G will cover most of your remaining expenses, except for the annual Part B deductible. So a High Deductible Supplement Plan G could work for someone who wants a lower monthly premium cost (which this plan has), but is willing to take the risk of a possible out-of-pocket spend of $2,340 per year.

In the past there were two High Deductible Supplement Plans available; High Deductible Plan F and Plan G. However, as of January 1, 2020 High Deductible Plan F (and regular Supplement Plan F) will no longer be available to people who are newly eligible for Medicare on or after that date. This means that High Deductible Plan G is the only high deductible Medigap option as of 2020.

What is covered under High Deductible Plan G

High Deductible Plan G covers the following expenses once a deductible of $2,340 is met:

Medicare Part A coinsurance and hospital costs (Up to an additional 365 days after Medicare benefits are used)

Medicare Part B coinsurance or copayment

Blood (First 3 pints)

Part A Hospice care coinsurance or copayment

Skilled nursing facility care coinsurance

Medicare Part A deductible

Medicare Part B excess charges

Foreign travel emergency (Up to plan limits)

What is not covered under High Deductible Plan G

Medicare Part B deductible

What is the cost of High Deductible Plan G

Every insurance carrier has different premium rates for High Deductible Plan G. The premium rate depends on factors such as your zip code, gender, age, and tobacco usage. However, because all of the Medigap Plans are standardized, meaning they offer the same basic benefits, you can choose the insurance carrier that offers the lowest premium price, and has the best company rating (which indicates it has stable pricing over time). Please give us a call to get a quote today!

Difference between Part A

and Plan A

If you are new to Medicare, all of the different “Parts” and “Plans” may be confusing. To simplify it, “Parts” refers to Original Medicare. There are two Parts to Original Medicare,

Part A and Part B. Part A covers about 80% of your hospital stay bills.

A Plan A refers to one of the 10 Medigap Plans (otherwise known as Supplement Plans), which you can add onto your Original Medicare to cover much of your remaining health care costs. One of these 10 “Plans” is Plan A.

Need more help from the Medicare Experts?

Our well trained agents are ready to answer questions about your Medicare health insurance, and put together a comprehensive plan to fit your needs. Request more information by any of the 3 ways bellow!

Call Us

866-599-6588

Schedule Appointment

Request

A Quote

Medigap Insurance Carriers is not affiliated or endorsed by the United States Government or the Federal Medicare Program. This is a solicitation of insurance.

An agent/producer may contact you for insurance. Medigap Insurance Carriers is a DBA wholly owned by John Ross Anthony Webb.

©Copyright | Medigapinsurancecarriers 2022. All Right Reserved